By the end of 2024, the majority of buyers in the $5 trillion tech and telco industry will be those born after 1982. These are digital-first, digital-only buyers. This is a game-changer for the industry.

As we navigate through this transformative year, it’s becoming increasingly clear that 2024 is pivotal for digital B2B marketplaces.

That’s why we recently hosted an online panel discussion “Ecosystem Talks” with leading industry experts: Jay McBain, Chief Analyst at Canalys; Max Kuzkin, General Manager at SoftwareOne; and Tim Tsao, Head of Stripe Partner Ecosystem, Programs, and Scaled Partners. They shared their views on how businesses can adapt to these rapid changes, highlighted key ecosystem and partnership trends that will significantly impact the tech industry, and covered much more. These are some of the key takeaways.

2024: An Inflection Point for Digital B2B Marketplaces

Jay McBain, Chief Analyst at Canalys, highlighted several factors driving the significant shift towards digital B2B marketplaces. The first factor is that the majority of today’s buyers have grown up with subscription and consumption models. With over 100,000 tech products available, these buyers approach research with the mindset of building their own tailored solutions. They don’t expect a single company to fulfill all their needs; instead, they prioritize integration. As Jay McBain puts it, “They buy in seven layers, they work with seven partners.” This new buyer demographic is fueling the growth of marketplaces, aligning with the broader trend toward a platform economy.

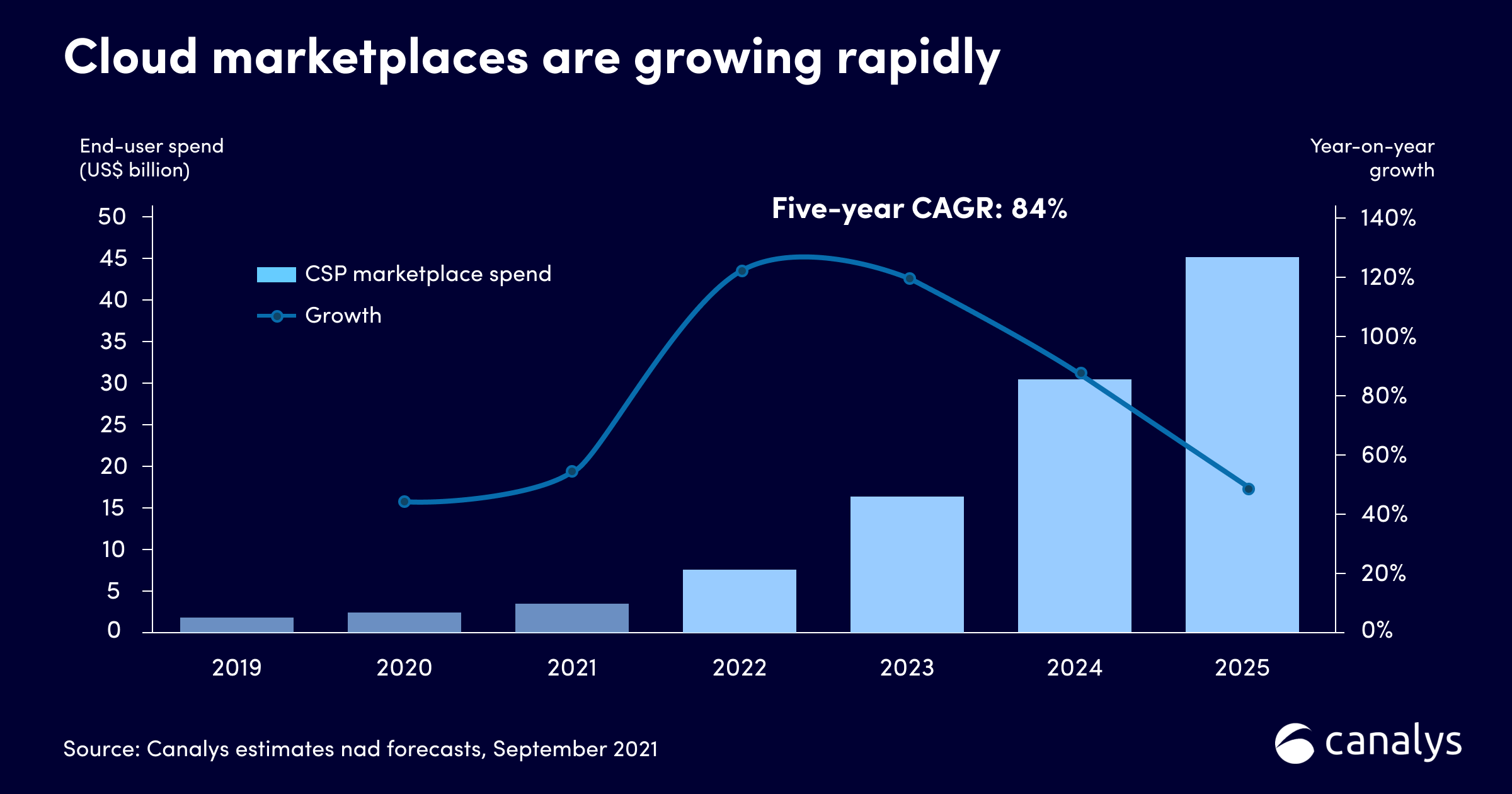

Jay also stated that a lot of software companies are looking to become platforms, with a key part of that execution occurring in a digital marketplace. What’s pointing to it? The staggering fact that over the last five years, marketplaces have been growing at an 86% compounded rate and are expected to continue significantly impacting how businesses and governments purchase technology. This growth is transformative, reflecting the shift towards platform-based companies dominating the S&P 500 and Fortune 500. Looking ahead, marketplaces will play a crucial role in technology procurement for at least the next decade.

Adapting Strategies for Cloud Marketplaces

Max Kuzkin, General Manager at SoftwareOne, emphasized the need for Independent Software Vendors (ISVs) to adapt their strategies to keep pace with the evolving dynamics of cloud marketplaces. With around 250,000 SaaS companies in the market, the transition to a subscription economy is far from complete. Many vendors are still grappling with the shift from traditional transactional methods to subscription models.

Kuzkin advised software vendors to focus on the bigger picture and avoid overcomplicating their go-to-market strategies. Cloud marketplaces should be seen not just as demand generation tools but as platforms to serve existing demand efficiently. He highlighted the importance of designing user-friendly business scenarios and interfaces, with a focus on practical implementation rather than overly complex API integrations.

The Evolution of Cloud Marketplaces

Tim Tsao shared a compelling story about the early days of cloud marketplaces. Ten years ago, he led the marketing efforts for the IBM Cloud Marketplace. Back then, the landscape was very different. Buyers hadn’t yet developed the expectation that they could complete entire transactions through a marketplace. On the supply side, product teams struggled with the transition from on-premises offerings to digital models. They faced numerous challenges, including pricing considerations and delivery implementation.

Fast forward to today, and the evolution is remarkable. Buyers now expect to browse, discover, and complete transactions entirely through marketplaces. The supply side has matured significantly, with offerings now tailored to fit marketplace models. Platforms have also become more flexible, accommodating billing, subscriptions, and monetization needs.

One of the most incredible developments in this space is the success of AWS Marketplace. AWS achieved a staggering $1 billion in revenue through its marketplace, underscoring the transformative power of this model. This milestone highlights how far cloud marketplaces have come and their significant role in today’s technology procurement landscape.

Conclusion

In 2024, the rapidly evolving digital B2B marketplace, growing at an 86% compounded rate, demands businesses adapt quickly and strategically.

The potential is staggering: by the end of the decade, the number of SaaS companies could hit one million, driven by innovations like generative AI.

To thrive in this dynamic environment, businesses must embrace cloud marketplaces not just as sales channels but as integral parts of their strategy. Focus on integration, leverage the power of ecosystems, and adapt to the subscription economy. The future of commerce is here, and it’s digital, interconnected, and ripe with opportunity.